Featured Post

Capital Gains Tax Calculator Crypto Uk

- Dapatkan link

- X

- Aplikasi Lainnya

Seamlessly track your capital gains capital losses and tax liability for every virtual currency transaction. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Best Bitcoin Tax Calculator In The Uk 2021

More about our UK tax support.

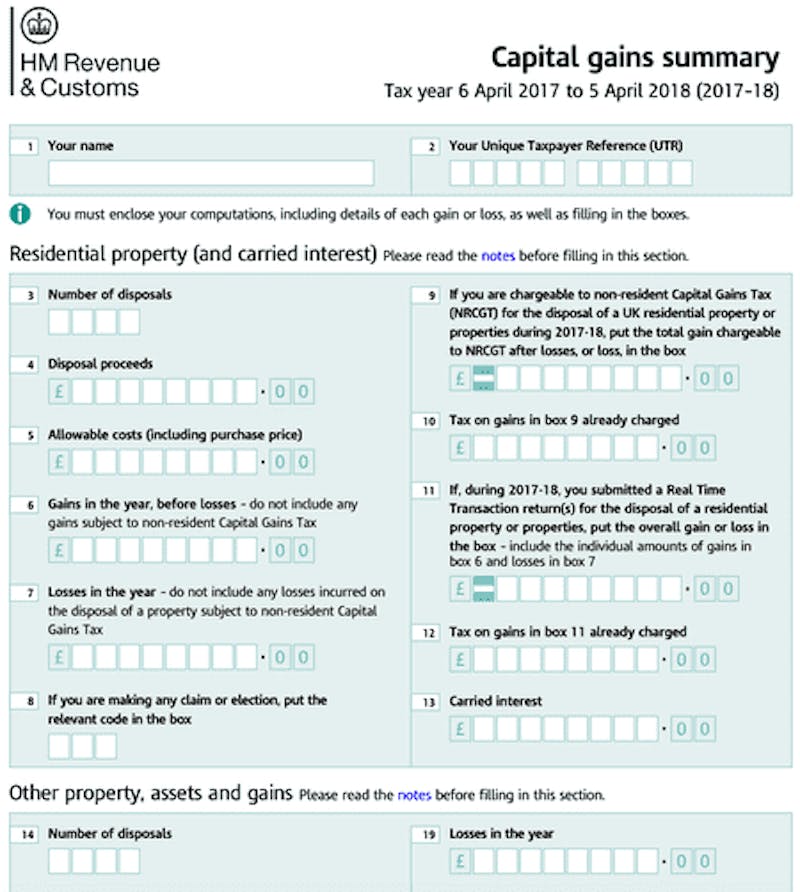

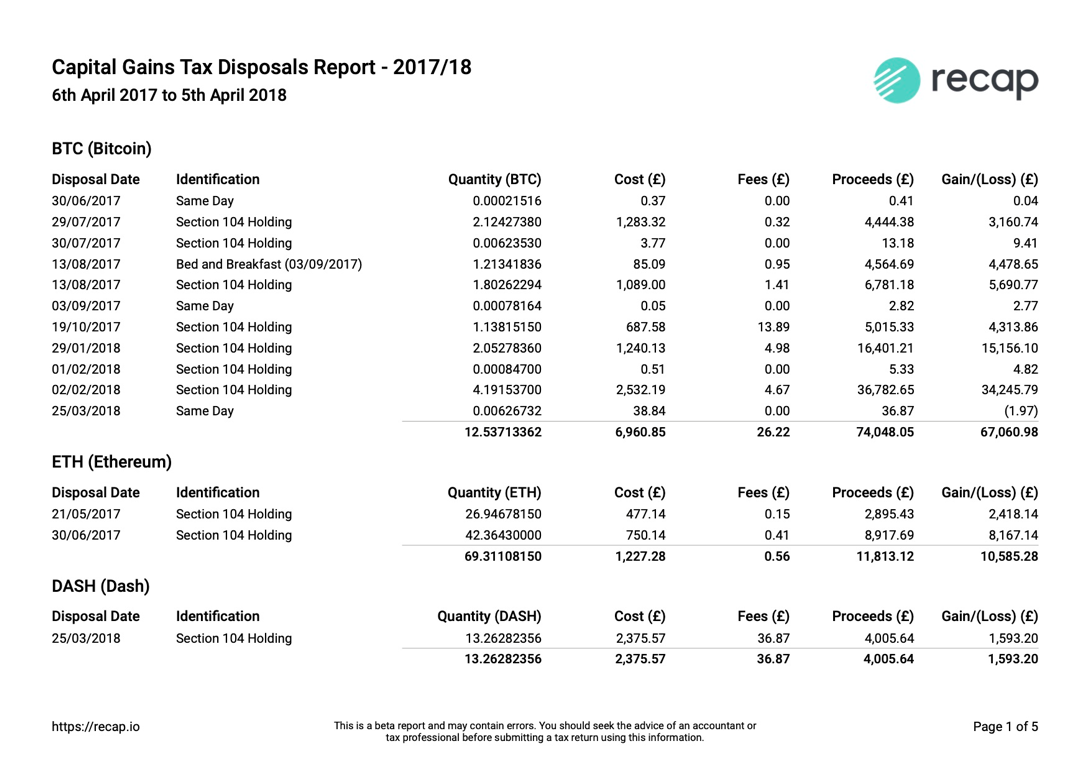

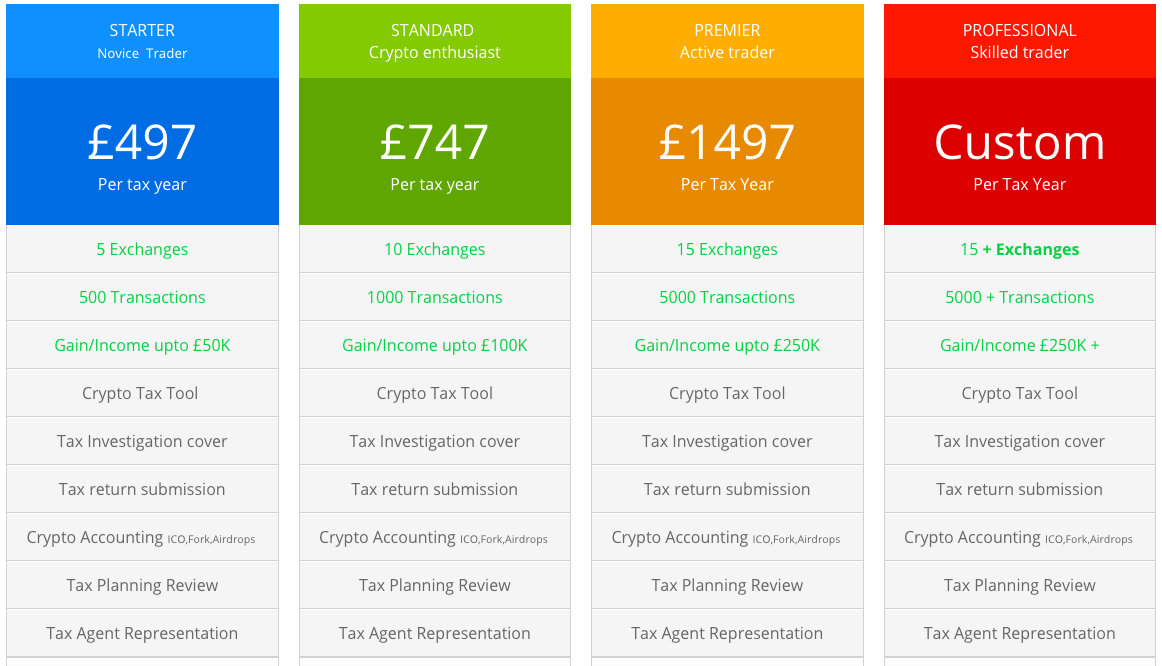

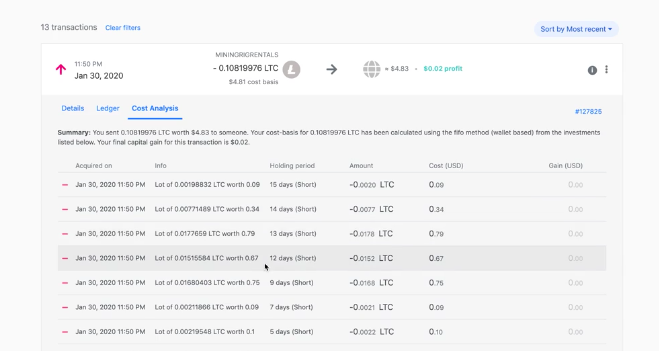

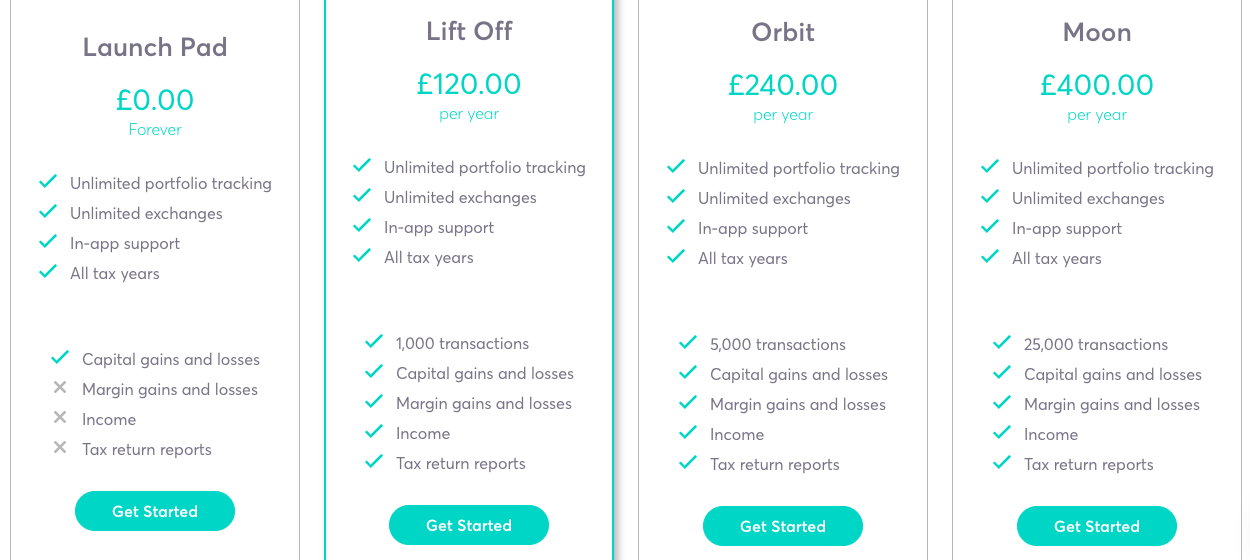

Capital gains tax calculator crypto uk. If you have Capital Gains Tax to pay. Generate a comprehensive disposal report for your accountant. Most people that have bought or traded any cryptocurrency chose to use a cryptocurrency tax solution to automate the process of calculating and reporting their capital gains.

EXAMPLE Natalie bought 1 BTC for 1000. Exchanging crypto assets for a different type of crypto asset. Using crypto assets to pay for goods or services.

If your crypto profits exceed the Capital Gains Tax allowance youll have to pay tax at the following rates. Enter as many assets as you want and make sure you have entered your other income and any losses you are carrying forward from previous years. You must report and pay any Capital Gains Tax on most sales of UK property within 30 days.

The formula we use to calculate these capital gains and losses is as follows. UK capital gains and income tax support. Calculate Capital Gains Tax on property.

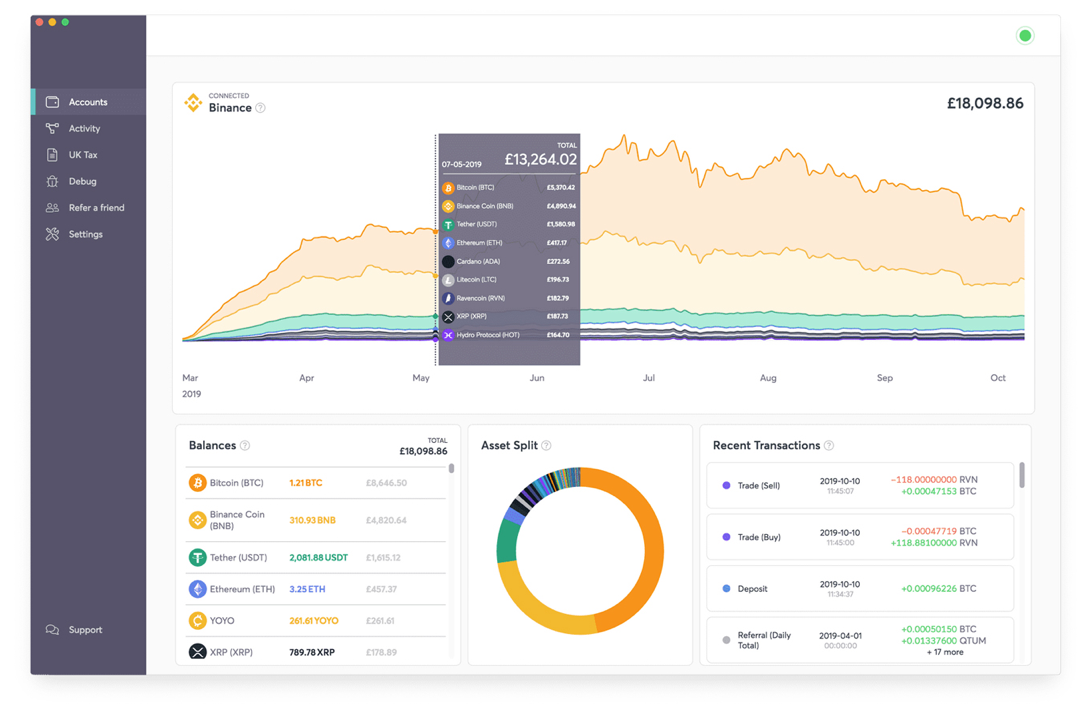

UK Capital Gains Tax Calculator Our Capital Gains Tax Calculator is a really simple way to quickly calculate the possible liability you have for CGT against any assets you have disposed off. Calculate your gains by applying same day 30 day and asset pooling rules. Coinpanda is one of very few crypto tax solutions that have full support for UK Share Pooling Share Identification rules.

To check if you need to pay Capital Gains Tax you need to work out your gain for each transaction you make. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. The way you work out your gain is different if you sell tokens within 30.

TokenTax is the only cryptocurrency tax calculator that connects to every crypto exchange. In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

6 months later she bought 05 BTC for 2000. Koinly is a cryptocurrency tax calculator that can easily import your crypto transactions and calculate your capital gains in accordance with the HMRC and Share Pooling rules. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Giving away crypto assets to another. 000038 728967 277. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc.

Selling crypto assets for money. The rate you pay on crypto taxes depends on your income level and how long you have held the crypto. No matter where your data is from well import and reconcile it with your trading history.

When it comes to cryptoassets in the UK you are subject to the capital gains tax upon disposal Disposal has been defined by HMRC as. You pay 127 at 10 tax rate for the next 1270 of your capital gains. Fair Market Value - Cost Basis GainLoss Fair Market Value is the market price of the cryptocurrency at the time you sold traded or disposed of it.

See your crypto capital gains and income since your first investment. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. What is a tax on cryptocurrency.

How is crypto tax calculated. Capital gains tax CGT breakdown. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax for basic ratepayers or 20 for higher ratepayers. You pay no CGT on the first 12300 that you make. How to calculate your UK crypto tax.

Save money using our Tax Loss Harvesting tool. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Until HMRC provides explicit advice to the contrary it is advisable to keep a spreadsheet of any purchases made with cryptocurrency no matter how small in case you exceed your personal capital gains allowance.

File your crypto taxes in UK. In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700. However if you trade cryptocurrency as a business such as mining Bitcoin the profits.

Koinly helps UK citizens calculate their crypto capital gains. So Jims capital gain in this instance is 280 277 003. This tax solution has in a short time become very popular in the UK and is today used by several thousand individuals to make it simple to calculate and report their crypto taxes.

![]()

Cointracking Crypto Tax Calculator

Uk Crypto Tax Guide 2021 Cryptotrader Tax

Uk Cryptocurrency Tax Guide Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

![]()

Cointracking Crypto Tax Calculator

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Uk Cryptocurrency Tax Guide Cointracker

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How Cryptocurrency Is Taxed In The United Kingdom Tokentax

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

Best Bitcoin Tax Calculator In The Uk 2021

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar