Featured Post

How To Avoid Capital Gains Tax On Cryptocurrency Australia

- Dapatkan link

- X

- Aplikasi Lainnya

This would work like the following take the total value of your holdings as of a particular date and pay say 1 of it as tax. By making your capital asset portfolio work for you without subjecting sales or transfers to capital gains tax provisions you can realize greater retention of your capital gains.

Theyll consider all the options and help you prevent or reduce the amount you are liable to pay including whether you are eligible to claim that the property.

How to avoid capital gains tax on cryptocurrency australia. Capital losses can be used to reduce capital gains made in the same financial year or a future year including investments outside of cryptocurrency. Of course tax advice is helpful along the way so it is best to wait until you talk to your advisor before making any changes with your investment property or. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain.

If youre an investor thats held your cryptocurrency for more than 12 months you may be eligible for a discount up to 50 on your capital gains tax payment. The easiest way to defer or eliminate tax on your cryptocurrency investments is to buy inside of an IRA 401-k defined benefit or other retirement plans. Convert cryptocurrency to fiat currency a currency established by government regulation or law such as Australian dollars or.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. This is an effective way to tax cryptocurrency and doesnt come with all the complexity and baggage that the capital gains tax does. Superannuation funds are allowed a 33 13 CGT discount.

Importantly if you hold for 1 year before disposing youll pay 50 less tax on crypto gains. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay. Dispose means to sell gift trade exchange convert or use crypto to buy things.

Tax treatment of cryptocurrencies. The CGT discount is allowed only where the capital asset has been owned for at least 12 months. Cryptocurrency generally operates independently of a central bank central authority or government.

Use cryptocurrency to obtain goods or services. To get the best possible advice on how to avoid capital gains tax in Australia you should talk to a tax accountant. Johns crypto tax obligations.

Only tax crypto to fiat transactions. In limited circumstances cryptocurrency holdings can be designated to be revenue assets of the taxpayer not capital assets. Capital losses can be used to offset capital gains either in the same financial year or in subsequent financial years.

If you buy cryptocurrency inside of a traditional IRA you will defer tax on. Buy Crypto Currency In Your IRA. If you make a capital gain on the disposal of cryptocurrency some or all of the gain may be taxed.

For many countries including the USA Canada Australia and parts of Europe cryptocurrency transactions are uniquely subject to capital gains tax and the onerous reporting requirements that. There are 5 ways you could pay capital gains tax on crypto in Australia. The impact of CGT on cryptocurrency trading is not as bad as you might think but there are ways to get it outside of the tax system entirely.

A Capital Gains Tax CGT event occurs when you dispose of your cryptocurrency. If you use cryptocurrency mainly to purchase personal items like a laptop that is not being used for your business then it can be tax-exempt. Capital Gains Tax.

If the value of your crypto is worth less at the time it is sold then when you bought it you have made a capital loss. Its important to remember that this discount is available for investors but not available for traders. How is crypto tax calculated in Australia.

You would only be subject to pay Capital Gains Tax on 2500 as opposed to 5000. If you donate your cryptocurrency to a registered charity then its not considered a capital gains event and you can claim the amount calculated as a fair price for the cryptocurrency at the time its donated as a deduction on your tax return.

South Korean Lawmakers Introduce Bill To Legalize New Icos Https Cointelegraph Com News South Korean Lawmakers Int Capital Gains Tax Capital Gain South Korea

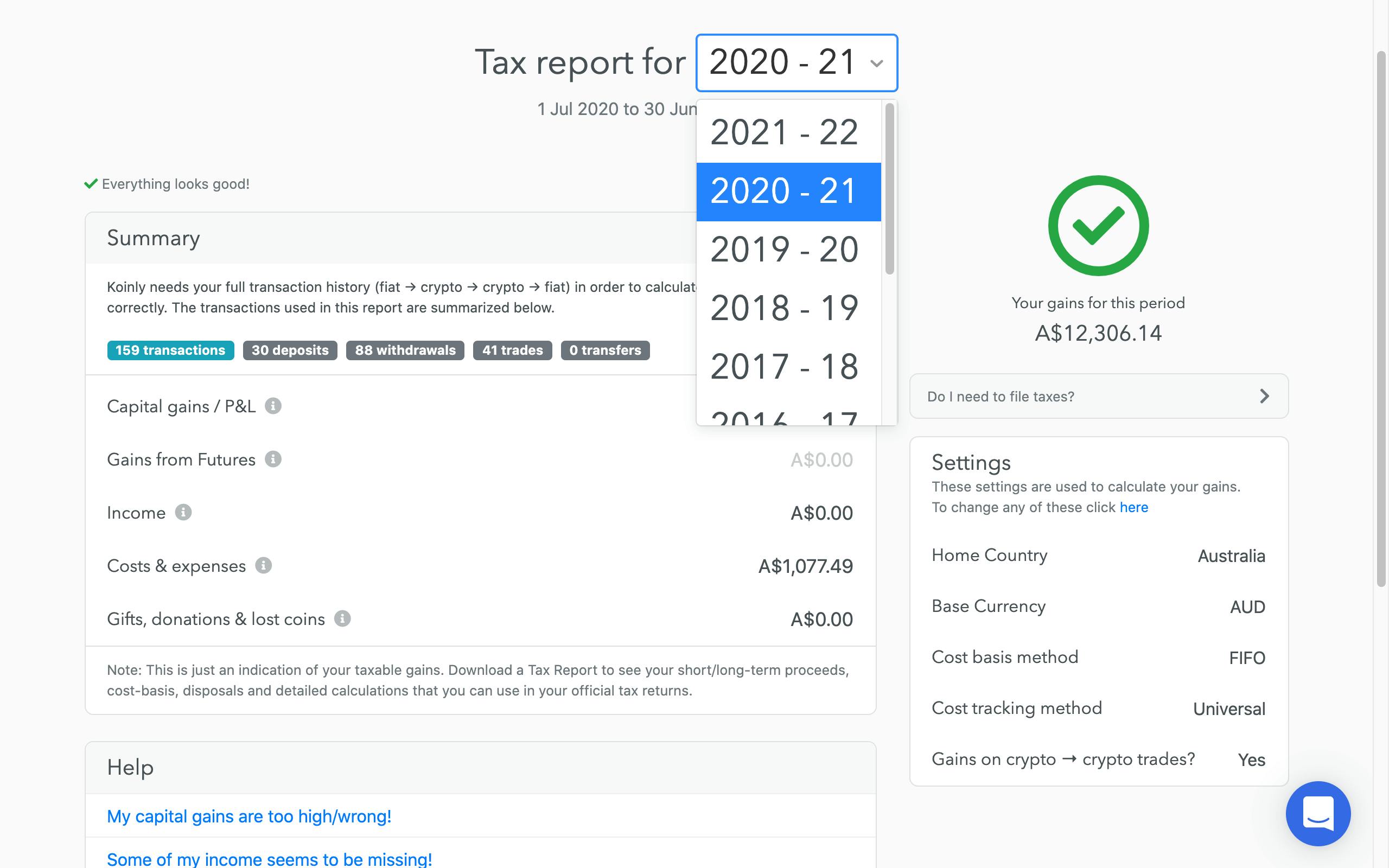

Australian Cryptocurrency Tax Guide 2021 Koinly

Guide To Crypto Derivatives What Is Cryptocurrency Derivatives Future Options Derivative Crypto Bitcoin

How To Pay Zero Crypto Taxes On Crypto Profits Cointracker

Australian Cryptocurrency Tax Guide 2021 Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Australia Ato Koinly

Slp Token Trading Platform Cryptophyl Adds Btc Pair With Bitcoin Cash At Flat 0 15 Fee Token Economy Btc Trading Bitcoin

The Bitcoin Crossroads Should I Trade Or Should I Hodl Forex Bitcoin Trading

Repin By At Social Media Marketing Pinterest Marketing Specialists Atsocialmedia Co Uk Crypto Market Pinterest Marketing Social Media Marketing Pinterest

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Crypto Tax In Australia The Definitive 2021 Guide

Australian Cryptocurrency Tax Guide 2021 Koinly

Common Mistakes To Avoid When Cryptocurrency Trading Cryptocurrency Trading Cryptocurrency Bitcoin Cryptocurrency

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

Cryptocurrency Taxation Australia 2019 Crypto Tax Tips Youtube

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Komentar

Posting Komentar